Confirmation Bias: The Killer of Wealth

After a recent listen to a great podcast involving Dave Chilton (The Wealthy Barber) and Richard Coffin (The Plain Bagel), there were multiple things that struck me, one of which being different biases. One of these was the idea of “Confirmation Bias”.

If you haven’t I encourage you to watch this podcast, it’s a great insight for all aspects of investing, biases, and online financial information: Youtube Podcast

Confirmation Bias Defined

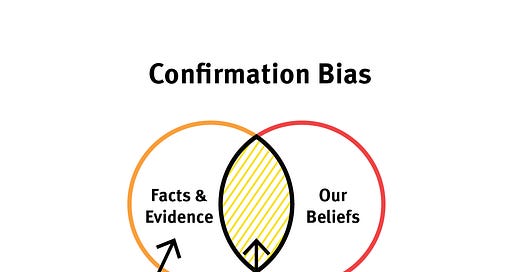

So what exactly is the idea of “confirmation bias”? Well it’s one of many psychological biases that we as humans fall into and it’s probably one of the most common. The simple explanation is that it’s a tendency for people to only look at/use information that supports ideas they already believe in. Have you ever discussed your ‘favourites’ with friends? Maybe it’s a favourite colour, favourite food, favourite vacation spot etc. Do you find yourself ACTIVELY searching out the friends that agree with you the most? This is a small example of your own confirmation bias. You want to talk with someone that proves YOUR opinion on the topic, you would rather find someone that agrees that french fries are the best rather than fighting about how there are so many other options.

As humans, we all want to be agreed with and liked in some way; this is basic psychology and human behaviour. It is much easier to discuss topics when the other side of the conversation always agrees with us. When there is a disagreement it creates tension where both sides try to prove why the other side is wrong. If you’ve ever had an aggressive argument with someone you’ll know how this feels at an extreme level. None of us enjoy getting into these discussions, and we especially don’t like having to fight for every opinion we have. However, this can be beneficial some of the time.

The Problem With Agreement

So what’s wrong about only discussing topics with people that agree? Well by itself there isn’t anything wrong, but you leave out a lot of information that you otherwise could have found. Missing information usually results from a lack of outside opinions or sources.

Have you ever had something you learned in school that later turned out to be false? This was most likely because you didn’t seek any outside sources (whether by choice or involuntarily) and so your “confirmation bias” assumed it was correct. Whether it was important or not, you did not have a chance to adjust your view because you assumed the information you learned in class was true. This is just a small example of confirmation bias at work in your life. We all have our own opinions about life, money, politics, and literally anything you can think of. It’s hard to change your thoughts when you have believed something for so long, and yet it’s one of the most important aspects of growth. When it comes to consuming new information, you must put your biases aside.

Confirmation Bias & Investing

One of the major areas where this bias may affect you a lot is in your investments. The most important aspect of investing is having completely TRUE transparency and a willingness to learn. Not only saying you do, but being able to put any negative or other information aside in order to learn something you have yet to hear. This is the way you counteract your confirmation bias. As investors we want the decisions to be right and so we search for other people with the same conclusions. This might lead to some good results, but what happens when the people you agree with turn out to be blatantly wrong?

Maybe it’s a company you buy, an index fund you found, an opinion about money, the risks you take, or a strategy you use to make money. Whatever it may be, you should not be jumping to conclusions based on one side of the story. Your unknowing bad decision might lead to even worse outcomes down the line. If you do not already, it’s time to start taking a look at outside thoughts.

The best thing you can start doing for yourself is to go into every topic and discussion with a neutral attitude and don’t come out of the conversation until you collect all the information. Unlike other areas of life, investing in particular is largely driven by data, statistics and factual information. While there may be conflicting opinions, there is often a yes or no answer to your question. There’s a peace in knowing much of what you think has already been discovered or tested and you can make both sound and concrete decisions.

Just remember that you might not be right no matter how convinced you may be. Don’t be so set in stone, learn to listen more. We all have our expertise, but make sure that doesn’t seep into areas that you don’t actually have the knowledge about.

As always, do your research and happy reading/investing!